Posted by Teresa on September 26, 2012 under Landlord Tips |

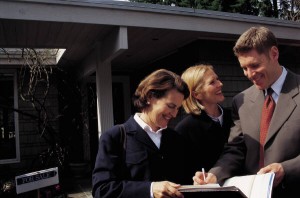

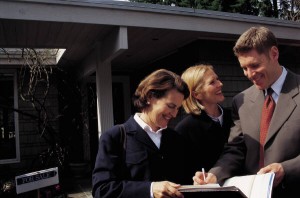

Have you ever had an idea tenant? Would you be able to spot another one if he or she submitted a rental application? Keep in mind we’re not talking literally here. Appearances mean nothing when it comes to judging who is an ideal tenant. And, choosing tenants based on appearances can get you in legal trouble.

Have you ever had an idea tenant? Would you be able to spot another one if he or she submitted a rental application? Keep in mind we’re not talking literally here. Appearances mean nothing when it comes to judging who is an ideal tenant. And, choosing tenants based on appearances can get you in legal trouble.

Rather, the following qualities and attributes make a tenant “ideal”:

- Ideal tenants have a rental resume, including references from previous landlords.

- They know how much rent they can afford.

- They don’t waste your time— they show up on time.

- They know their credit score, and are ready to explain any issues.

- Ideal tenants have saved up enough cash to cover the security deposit and first month’s rent, along with application fees, tenant screening fees, pet deposits and utilities deposits. Even better? They have several month’s rent in the bank—and the bank statements to back them up.

- Speaking of pets, ideal tenants don’t pretend to not have a cat, bird or dog. They don’t apply for rental units that don’t allow pets, and then try to sneak one in when you’re not looking.

- If pets are allowed, ideal tenants also have references from previous landlords for their pets.

- They fill out the lease application thoroughly and truthfully.

- Ideal tenants know that appearances do matter. Again, you cannot discriminate against an applicant based on race, religion, gender, family status and other factors. And plenty of landlords can tell you that tenants who look rough around the edges are often hard-working people who always pay their rent on time, while flashy dressers may live above their means and have credit problems. That said, applicants who take the time to dress nicely demonstrate respect and just might take good care of your property.

- Ideal tenants are excited about your rental property and look forward to making it their home.

Posted by Teresa on August 31, 2012 under Lease and Rental Agreements, Rents and Deposits, Tenant Credit Checks |

How do you say “no” to tenants who don’t meet your lease qualifications? Some landlords have a hard time doing so, especially when the applicants are persistent. Here are a few examples:

How do you say “no” to tenants who don’t meet your lease qualifications? Some landlords have a hard time doing so, especially when the applicants are persistent. Here are a few examples:

- Don denied an applicant based on weak credit. The applicant offered a bigger security deposit. Now Don is thinking of approving his application.

- Karen is a landlord in a similar situation. Her non-qualifying applicants offered to pay an entire year’s rent up front. Karen decided to accept the deal and signed the lease.

- Another landlord reports that a non-qualified couple is pleading with her to rent to them, saying they have not found another rental that meets their needs. The woman has good credit; the man has terrible credit. The landlord is thinking of putting only the woman’s name on the lease, with a substantial cash security deposit.

What is wrong with each of these decisions?

- In the first example, Don is allowing a larger security deposit to cloud his judgment. First, he lives in Massachusetts, where landlords are limited to charging no more than one month’s rent for a security deposit. Next, he is bending his own rules, which is a slippery slope. If a tenant knows he’ll cave on one aspect of the tenancy, they may be likely to push other rules, as well. Is the rent really due on the 1st? Wouldn’t it be okay to move some extra family members into the rental unit? Finally, treating every applicant equally is important to avoid charges of discrimination. Let’s say the next applicant also had bad credit and Don refused to sign a lease with them. They might charge that Don showed preferential treatment to the first tenant and that they are being discriminated against, due to their race, religion, family status, gender, age, etc.

- In Karen’s case, one might think that paying a year’s rent up front would erase any worries about the tenant’s financial situation. However, most strong tenants don’t offer prepaid rent—especially a year’s worth—because they can’t afford it. Karen should ask herself why an applicant with bad credit has that much cash laying around. Have they been scamming other landlords and living rent-free? Have they been evicted? Or are they involved in an illegal cash enterprise? The offer of a year’s worth of rent up front should be a red flag.

- In the third example, this landlord is asking for trouble. All adult residents should be put on the lease and held liable for the terms of the lease. What guarantee does the landlord have that the female will always be responsible for the rent? What if the couple breaks up and she moves out? The landlord will have a resident living in the rental unit without a lease.

Experienced landlords know that sticking to your standards and leasing only to solid tenants who meet your criteria are important steps in building a successful rental business. If denied applicants don’t hear your “no,” just say it again. And louder. And then, hold out for well-qualified tenants. Tenant screening on every applicant, with minimum qualifying credit scores, is a landlord’s best practice.

Posted by Teresa on July 17, 2012 under Fair Housing Act, Landlord and Tenant FAQs, Tenant Screening & Background Checks |

No matter if you’re a long-time landlord or new to the business, you’ll likely encounter a wide mix of tenants. Some will be easier to deal with than others. They pay their rent on time, follow your rules and cause no problems. Other tenants can only be described as problem tenants. Most landlords would probably agree that if they could turn back the clock, they would not have agreed to lease to these tenants in the first place.

No matter if you’re a long-time landlord or new to the business, you’ll likely encounter a wide mix of tenants. Some will be easier to deal with than others. They pay their rent on time, follow your rules and cause no problems. Other tenants can only be described as problem tenants. Most landlords would probably agree that if they could turn back the clock, they would not have agreed to lease to these tenants in the first place.

Trouble is, you can’t always know if a tenant will be a problem. Experienced landlords know that even those with good jobs, good credit scores and sparkling references can later turn out to be duds—or worse. But there are warning signs that every landlord should know.

Five Warning Signs of Problem Tenants

- They gripe about the application fee. Good tenants realize that running background checks and tenant credit checks, calling references and processing paperwork take time and money. They pay the application fee without complaint. A lease applicant who can’t pay the fee, or complains about it, is a red flag.

- They ask for more time to pay the first month’s rent and security deposit. Sure, it can be tough to come up with that much money at once. But remember, you’re running a business, not a charity. If a tenant cannot pay all of the rent and security deposit up front, you may want to pass on him or her and wait for someone who can. It’s a matter of choice. Let another landlord deal with it.

- They are new at their job. This isn’t always a bad thing. Plenty of people switch jobs because they’re offered better positions that pay more, and they can afford more rent. But if a prospective tenant has had several jobs in the past two or three years, the new job might not last for long. And soon, the excuses for paying rent late will begin.

- They mention relationship problems. Keep in mind that according to the Fair Housing Act, landlords may not discriminate against applicants based on marital status. It’s illegal to refuse to rent to a divorced person, a single person or a married person because of their status alone. But if an applicant mentions boyfriend or girlfriend problems, or that he or she is trying to get away from someone, consider these red flags. Trouble typically follows people around. If you don’t want an upset estranged husband or troubled ex-girlfriend on your hands, pass on this tenant.

- They ask too many questions. There’s a fine line between having a healthy interest in your rental property and showing warning signs of being a problem tenant. Be on alert if a prospective tenant asks about things like:

- The racial makeup of your building or the neighborhood.

- Exactly what the electric, sewer or gas bills will be.

- How to file complaints or repair requests.

- Where they can smoke (if you have a non-smoking property).

- How often you’ll be inspecting the property, and how much warning you’ll be giving.

- The type of questions, the number of them, or the way they are asked can tell you a great deal about the person who’s applying to live in your property.

As a landlord, you get to decide with whom you enter into a lease agreement. Keep your eyes and ears open, trust your gut instinct and always verify everything a prospective tenant tells you.

No matter how competitive your rents are, you need to protect your rental property and assets with tenant background checks. Proper tenant screening will ensure you are leasing to the best possible tenants.

Posted by Teresa on June 26, 2012 under Housing Trends |

When the economy is still sputtering and jobs are still hard to come by, average Americans are seeing their homes lose value and rents going up. But that happens to the super rich, too. In fact, the number of homes with rents that top six figures is rising. Demand is high and supply is short in the “trophy home” market, with tenants who are willing to pay each month what many of us would like to earn in a year.

When the economy is still sputtering and jobs are still hard to come by, average Americans are seeing their homes lose value and rents going up. But that happens to the super rich, too. In fact, the number of homes with rents that top six figures is rising. Demand is high and supply is short in the “trophy home” market, with tenants who are willing to pay each month what many of us would like to earn in a year.

For example, in Manhattan, the wealthy can rent an apartment where composer Cole Porter once lived. It has five bedrooms and five and a half baths, and rents for $150,000 per month. It’s located in the Waldorf Hotel, so tenants also get twice-a-day maid service. Another suite on the same floor rents for just $135,000—a savings of $15,000! per month

On the West Coast, several Beverly Hills homes fit into the $100K and over category. One boasts a disco and tennis court and goes for $195,000 per month. Beverly Hills is popular with actors and musicians who are in town for short periods of time and want luxurious mansions.

Brokers who work with the tenants who can afford these rentals say their clients are often celebrities like Beyoncé, foreigners, such as Saudi royalty, or entrepreneurs who need short-term housing. They want security and privacy, along with room for their staff of chefs, nannies, personal trainers and chauffeurs.

Other mega-rich tenants have a lot in common with an increasing number of “average” renters—they simply want flexibility in their housing. Rather than owning a home that may or may not sell when they’re ready to move, renting offers them the ability to move without hassle whenever they want—to a place like the Malibu beachfront home owned by actor Leonardo DiCaprio, with a $150,000 monthly rent.

No matter how rich your prospective tenant is, you need to protect your rental property and assets with tenant background checks. Proper tenant screening will ensure you are leasing to the best possible tenants.

Posted by Teresa on May 20, 2012 under Rents and Deposits |

Our last post covered ways to incentivize tenants to pay rent online. One reader asked for a list of online rent payment services. So we’ve rounded up a list of popular online rent payment services, along with what makes each one unique.

Our last post covered ways to incentivize tenants to pay rent online. One reader asked for a list of online rent payment services. So we’ve rounded up a list of popular online rent payment services, along with what makes each one unique.

RentPayment – This company says it’s the largest electronic payments processor in the multifamily industry. RentPayment was founded in 1999 and has since acquired a couple of competitors along the way. The company offers credit card and debit card rent payment on their website. Tenants can also pay rent by phone, by using the company’s iPhone app, or by text. Tenants who sign up for RentByText get monthly text reminders when rent is due. They simply reply “Pay,” and their rent is automatically paid via their debit/credit card or through an e-check. Property managers collecting paper checks can use RentPayment’s check scanning services to capture check images digitally, and then deposit them without leaving the office.

RentPayment’s extensive marketing efforts are intended to increase use of its services. They offer magnets, brochures, posters and signs to help spread the word about the advantages of paying rent online through their services.

Pricing: The monthly fee is $9.95 to set up accepting e-check payments through RentPayment, which includes 10 e-check transactions. Funds are deposited into your bank account within one or two business days. Tenants may pay online for free. Additional e-checks are $1.00 each. The fee to accept credit cards is 2.95% of the total amount. Debit cards are 1% of the total amount. Tenants may pay online, by phone, or text for free.

PayLease – PayLease also offers rent payments via e-checks and credit cards, either one-time or recurring. They also offer the means for property managers to make payments into the building owner’s bank account. Another unique feature of PayLease is an integrated online lease application system. Prospective tenants may submit an application and pay the application fee at the same time. Property managers are notified via email that a new application has been submitted.

Tenants may pay rent online or over the phone. Email reminders are also avaialable.

Pricing: PayLease allows rental property owners to pay the transactions fees for online payments, or pass the fee along to tenants. The company also offers a rebate program. The more online payments tenants make, the bigger the rebate. Monthly and/or transaction fees are priced individually.

PayYourRent – PayYourRent was developed by property managers. They offer rent and security deposit payment processing by e-check or credit card, along with additional automatic management services, such as maintenance requests, rental applications, utility connections and check scanning. PayYourRent also offers a payment portal that you can customize with your company’s logo, address and other information.

Pricing is provided upon request. Tenants may pay rent online. PayYourRent offers 24-hour payment processing, so funds are available more quickly.

eRentPayment – eRentPayment allows property managers to collect rent, application fees and security deposits online. Tenants may pay rent online each month, sign up for recurring automatic payments or pay by phone. Managers may also refund security deposits to tenants through the service. Rent payments submitted late are automatically charged a late fee, and managers/owners have the option of blocking partial payments. There are no extra fees to use multiple bank accounts.

eRentPayment offers a solution for tenants without Internet access, as well. Managers may submit a form, signed by the tenant, authorizing an automatic monthly debit from their bank account. Tenants may not alter the payment without submitting another application.

Pricing: Each transaction is $3.00. Property owners and managers may choose to pay the entire transaction fee, split it with the tenant, or have the tenant pay the fee. eRentPayment also offers vacancy listings for no charge.

Posted by Teresa on April 6, 2012 under Rental Market |

The rental market is seeing some new faces. Rental property investors now include people who, a few years back, may not have ever considered becoming landlords. Income tax records show 9.3 million taxpayers who claimed rental income in 2009, which is up from 8.3 million in 2003.

The rental market is seeing some new faces. Rental property investors now include people who, a few years back, may not have ever considered becoming landlords. Income tax records show 9.3 million taxpayers who claimed rental income in 2009, which is up from 8.3 million in 2003.

Several factors are contributing to this trend:

- The rental market is strong, and it keeps growing. More people are choosing to rent rather than buy homes, due to job instability, poor credit, stringent lending standards and insecurity about housing prices.

- Home prices are staying low. Prices have been falling since the bubble burst, and although experts have said we’ve reached the bottom more than once, the numbers indicate otherwise.

- Interest rates are staying low. Near-historic low rates mean taking on a mortgage makes sense for good credit risks.

- Investment returns are lousy lately. U.S. stock funds lost an average of 2.9% in 2011, and safer investments, such as bank CDs are returning rates of 1% or 2%. Investors view real estate as a better opportunity.

- People see tax benefits in owning rental property. According to Reuters, in 2009, those 9.3 million income tax filers claimed about $267 billion in rental income. However, they claimed more than that in depreciation and expenses, for a total loss of $11 billion.

Of course, things can change quickly. Housing prices will eventually recover. The jobs picture will improve at some point. Interest rates will creep back up. And rents will level off. Landlords who enter the business now when demand is high, tenants are plentiful and rents are healthy may find themselves ill equipped to deal with any downturns that will surely come.

Posted by Teresa on January 5, 2012 under Rental Market |

For landlords in most markets, 2011 was a good year, with low vacancy rates and higher rents than previous years. What can landlords expect to see in 2012?

For landlords in most markets, 2011 was a good year, with low vacancy rates and higher rents than previous years. What can landlords expect to see in 2012?

Strong growth in rental demand. Forecasters say demand will continue to grow for rental housing, based on a continued weak job market. Employment is expected to improve at a slow rate, which could increase demand as more people move out of shared housing situations.

A continued soft housing market. Losing renters to home purchases will probably not be a big issue for rental property owners. In some areas, such as Texas, home sales started increasing in the last half of 2011. Wherever employment growth occurs, demand for rentals will continue, and some home sale increases are expected.

Lower than normal supplies of multi-family housing. While construction permits are increasing and new development is starting to happen, most big construction projects are still in the planning phase. In most areas, new supply levels won’t be much higher in 2012. Exceptions are Washington DC, Dallas, Tex. and Orange County, Calif.

Higher occupancy rates. The economy will continue to produce renters for low- and mid-tier properties. High-end properties are still in high demand, but as wages stagnate, more renters will be pushed into lower rents, driving those occupancy rates higher.

Rent growth of 4% to 4.5%. Property owners who continue to increase rents could see higher turnover; others will likely see value in keeping existing tenants.

Top Ten Rental Markets for 2012

- San Francisco will continue to lead the nation in apartment rental growth, followed by:

- Austin, Tex.

- San Jose, Calif.

- Oakland, Calif.

- Boston, Mass

- New York City

- Denver, Colo.

- Dallas, Tex.

- Charlotte, North Carolina

- Houston, Tex.

Protect your rental property and assets through tenant background checks. Proper tenant screening will ensure you are leasing to the best possible tenants.

Posted by Teresa on September 21, 2011 under Landlord Paperwork and Forms, Lease and Rental Agreements |

As a landlord, do you keep track of tenant lease renewal dates? It’s important to do so, for a few reasons.

As a landlord, do you keep track of tenant lease renewal dates? It’s important to do so, for a few reasons.

If you’re on a one-year lease schedule, set reminders to contact tenants prior to the lease expiration to thank them for leasing your property and inform them it will soon be time to sign a new lease. If you will be raising the rent, now is the time to inform your tenant. You may wish to provide a perk such as an appliance upgrade or new carpet to entice them to renew at the higher rent.

At lease signing, have your tenant fill out an updated information form, so you can be sure to have current employment information, emergency contacts, current occupants and vehicle license numbers:

- You’ll want the employment information in case your tenant vacates the unit and owes you rent. If you’re forced to go to court to collect, you’ll want to know where you can garnish the tenant’s wages, if it comes to that.

- Personal and emergency contacts are important, not only in case of an actual emergency, but again, if the tenant breaks the lease and owes you rent, you’ll have a place to start looking for him or her.

- Vehicle license information is vital to keeping unauthorized or unknown vehicles off your property.

- Asking for current occupants are a great way to discover if there are unauthorized residents staying in your rental property. If there are “guests” over age 18, you’ll want to point out the lease clause that covers your guest policy (such as limiting guests to two consecutive weeks in any six month period) and require lease applications and tenant background checks from anyone living in your rental unit who is not on the lease. Of course, if the new tenant is permanent, you’ll need a to draw up a new lease that includes his or her name.

Remind tenants that they must provide written notice if they intend to move out at the end of the lease. Ask for an exact date they will be vacating. However, don’t promise the unit to a new tenant until you are absolutely sure that the old tenant is moving out.

Posted by Teresa on March 4, 2011 under Landlord Tips |

Sometimes landlords simply can’t fill a vacancy, despite market data that shows vacancies are low and would-be renters are finding it hard to find a place to live. Have you ever had a vacancy that should have been filled, but after many showings you have no bites?

Sometimes landlords simply can’t fill a vacancy, despite market data that shows vacancies are low and would-be renters are finding it hard to find a place to live. Have you ever had a vacancy that should have been filled, but after many showings you have no bites?

Consider these reasons you’re having trouble filling a vacant rental:

Price: Have you checked the rents in your area lately? Perhaps yours is just too high for the number of bedrooms, bathrooms and amenities your rental property offers. Do your homework and adjust the rent if you have to. Try rentometer.com to compare your rent to others in your city—and even in your neighborhood.

Location: Is your rental property too far from public transportation and shopping? While there’s not much you can do to make a poor location better, you can promote other advantages of the location. Is there a park or walking and biking trail nearby? Is it a walkable neighborhood? What about a neighborhood market? Think about other factors you can educate potential tenants about. What would make you want to live there? And don’t expect the location to sell itself—that’s your job!

Utilities: Most tenants want cable and high-speed internet. Wireless is even better. If you don’t offer the latest and greatest technology, you could be losing tenants for that reason alone. Inquire with your cable and internet service providers to see what they can do to upgrade your property and bring it into the 21st century!

Looks: Take a hard view at how your rental looks from the outside and the inside.

- Does it look inviting?

- Are there dead shrubs outside and broken window blinds inside?

- Does it need a paint job?

- Are carpets worn out?

- Do the fixtures and lighting need an upgrade?

- If it’s been awhile since you spruced up the place, it could be costing you money as potential tenants turn it down.

Finally, when you’re showing the unit, ask potential tenants if they can picture themselves living there. It doesn’t hurt to find out what they’re thinking, and you’ll learn very valuable information. If they offer an objection, find a way to overcome it—and fill that vacancy!

Pre-screen all tenants as part of your standard application process. Background and credit checks will help ensure you rent to qualified tenants. For more landlord resources, including forms and information on tenant screening, turn to E-Renter.com.

Posted by Teresa on February 24, 2011 under Landlord Tips, Tenant Screening & Background Checks |

Tenant screening is a several-step process. It begins with the lease application, where you obtain the lease applicant’s signature to run a background and credit check. It ends with phone calls and other verifications to check employers, previous landlords and other references listed by the tenant.

Tenant screening is a several-step process. It begins with the lease application, where you obtain the lease applicant’s signature to run a background and credit check. It ends with phone calls and other verifications to check employers, previous landlords and other references listed by the tenant.

In between is the professional tenant background check, which should include:

- SSN Validation

- OFAC/Patriot Act Search

- Evictions

- Bankruptcies

- Liens & Judgments

- Criminal Records Search

- Sex offender Search

- Credit Check

- Name and Address Validation

Skipping any of these necessary steps is usually a mistake – just ask landlords who have! You might be tempted to forget about calling previous landlords if the credit check comes out clean. You might be tempted to skip the tenant background screening if the applicant tells you up front that he had a drug conviction five years ago. When tenant applicants are so honest up front, they must have nothing else to hide, right? Maybe. Maybe not.

When your gut tells you someone is honest and deserves a chance, don’t listen! Do your due diligence and find out for sure if they can be trusted to live in your rental property, take care of it properly, and pay rent on time every single month.

Conducting due diligence on a potential tenant takes a little time and effort on your part. Experienced landlords will tell you to listen for clues when you’re talking to references and former landlords to determine whether you need to dig any further.

- Clue #1: Former landlord says that applicant was never any trouble and paid rent on time. Would happily rent to them again and again.

- Ask: Why are they moving? How long have you owned the property? How do you spell your name? What is the legal address of the rental property?

- Double-Check: Tax records to make sure the person you are talking to is indeed the owner of the property in question. Potential tenants have friends pose as landlords. How do you know you’re talking to the landlord? Hint: When calling the number, ask “how do you know John Doe?”

- Clue #2: Employer says applicant was never any trouble, makes enough money to cover rent and is still gainfully employed.

- Ask: What is your name and position at the company? Ask even if the name is on the application in front of you. Potential tenants have friends pose as supervisors.

- Double-Check: Google the company name, address, phone number. Call the business and ask for the person you were speaking to – don’t just call the number you were given.

- Clue #3: Tenant applicant cannot provide paystubs.

- Ask: For W2s or tax returns. If you don’t get them, move on to the next applicant.

Verifying tenant references is as important as formal tenant screening. Don’t base important decisions on your gut. Verify, then trust!

Have you ever had an idea tenant? Would you be able to spot another one if he or she submitted a rental application? Keep in mind we’re not talking literally here. Appearances mean nothing when it comes to judging who is an ideal tenant. And, choosing tenants based on appearances can get you in legal trouble.

Have you ever had an idea tenant? Would you be able to spot another one if he or she submitted a rental application? Keep in mind we’re not talking literally here. Appearances mean nothing when it comes to judging who is an ideal tenant. And, choosing tenants based on appearances can get you in legal trouble.