Posted by Teresa on September 21, 2009 under Screening and Background Checks, Tenant Credit Checks, Tenant Screening & Background Checks |

It’s rather difficult to find anyone who has not been affected by the economic troubles of the past year. That includes people who want to be your tenants. What should you look for when running tenant credit checks these days? If everybody’s credit is bad, why bother to do a credit check? Should landlords and property managers lower their standards in light of the rise in rental vacancies? Read on for answers to these questions.

It’s rather difficult to find anyone who has not been affected by the economic troubles of the past year. That includes people who want to be your tenants. What should you look for when running tenant credit checks these days? If everybody’s credit is bad, why bother to do a credit check? Should landlords and property managers lower their standards in light of the rise in rental vacancies? Read on for answers to these questions.

Why bother with a tenant credit check when it’s going to be bad? Besides, if I skip it, I save money, right? Actually, the money you invest by doing thorough tenant screening will more than pay for itself when you consider the long term cost of evicting and/or cleaning up after bad tenants. And believe it or not, lots of folks are making it through the down economy by spending less, saving more, and keeping their credit records clean.

Should I lower my standards? This is a tough rental market, with rents down and vacancies up. You must decide whether to keep your qualifying standards high—and face empty units—or take a chance by lowering them in order to fill your properties. Experienced landlords say that empty units are far better than renting to bad tenants. It all depends on your tolerance risk, your cash flow—and a lot of luck.

Can I ask why a prospective tenant has had a bankruptcy? Yes. There is no time like the beginning to start communicating clearly with your tenants. If there is a bankruptcy on the credit check, ask what happened. You may find out that medical bills forced the tenant into bankruptcy, or that an ex spouse was actually the cause. Of course, if the tenant has other red flags on the credit report, you must take them into consideration, too.

Take a wide-angle view of the tenant’s credit history. If a bankruptcy is several years in the past, and everything else checks out, they may be an acceptable risk. If the bankruptcy was due to a business failure, the economy could be to blame—not the tenant. Past evictions and utility judgments are a higher risk indicators to many landlords than bankruptcies.

Do not ignore your gut instinct. If someone seems untrustworthy, they very well might be. Only you can decide whether a poor credit score or bankruptcy is worth the risk. The important thing is to perform consistent tenant credit checks!

Posted by Teresa on September 14, 2009 under Screening and Background Checks, Tenant Credit Checks, Tenant Screening & Background Checks |

Pre-qualifying tenants means a good start to a mutually respectful, mutually beneficial landlord/tenant relationship. So what exactly is pre-qualifying, and how do you begin to implement this strategy? Here’s a list of what pre-qualifying is and is not:

Pre-qualifying tenants means a good start to a mutually respectful, mutually beneficial landlord/tenant relationship. So what exactly is pre-qualifying, and how do you begin to implement this strategy? Here’s a list of what pre-qualifying is and is not:

- Pre-Qualifying is about finding the people who fit the minimum requirements you set for income, references, job and credit history. Proper tenant screening will further narrow the field by giving you solid background check results to base your decision on.

- Pre-Qualifying is not about discrimination. As a landlord, federal law prevents you from using a person’s race, color, religion, nationality, familial status, age, gender, or disabled status to determine housing eligibility. Your state may have additional guidelines.

- Pre-Qualifying is about laying the groundwork for a great landlord/tenant relationship by communicating clearly and effectively from the start.

- Pre-Qualifying is about reducing tenant turnover by avoiding broken lease agreements and evictions.

- Pre-Qualifying is not about judging applicants based on personal appearance, the car they own, or the number of people in their family unit.

- Pre-Qualifying is about applying the same rules and requirements to all applicants.

- Pre-Qualifying is a way to reduce your risk by keeping tenants with previous criminal convictions or negative rental histories out of your rental properties.

- Pre-Qualifying is started by advertising your property for rent in the right publications, including enough information to weed out individuals who are not a good fit for your rental.

Every landlord should consider pre-qualifying tenants. While it takes effort to begin any new procedure, it will soon be a habit—and this is a habit that will pay off through better relationships with your tenants and increased profits for you!

Posted by Teresa on September 2, 2009 under Landlord Tips, Tenant Screening & Background Checks |

Do you have a guest clause in your lease agreement? If so, your tenant has agreed that no guests can stay in the rental unit longer than the time specified on the lease. For some landlords, that’s seven days; for others, fourteen. And some specify no guests for more than fifteen days out of any thirty-day period.

Do you have a guest clause in your lease agreement? If so, your tenant has agreed that no guests can stay in the rental unit longer than the time specified on the lease. For some landlords, that’s seven days; for others, fourteen. And some specify no guests for more than fifteen days out of any thirty-day period.

If your current lease agreement does not contain this important clause, make sure you add it before you sign another lease with this or any other tenant. This way, you will avoid a sticky situation: when your tenant allows a guest to stay indefinitely in your rental property.

On one hand, your tenants are free to certain enjoyment of their rental unit, including entertaining friends and hosting guests. But on the other hand, when a guest becomes a permanent fixture, you could be held liable for their actions. Having an unknown entity living in your rental unit puts you at risk, along with your other tenants, and the neighbors.

Hands-on landlords must balance staying on top of their tenant’s activities with being a nosy pest. However, you have every right to know what’s going on in and around your property. So, when you observe a guest at your rental unit who appears to have moved in, it’s time to ask the question.

If you’ve established good communication with your tenant, then asking if “Joe-Bob,” “Alison,” or “Spike” have moved in is completely reasonable. If the tenant is a good one whom you’d like to retain, then take a rational approach. Be prepared to offer options to your tenant: if they have broken the rules outlined in the lease, then they need to have the person leave, or add them to the lease—with proper background screening, of course.

It’s vital that you enforce the terms of your lease completely and evenly—every rule applies to every tenant. And, it’s important that your tenants know you mean business and that you expect them to live up to their agreement. Letting something like this slide can only lead to further—and possibly larger—problems.

Of course, hands-off landlords don’t often know who’s coming and going in their units—so their tenants can get away with stretching the terms of their lease. After all, if you’re not paying attention, they’re probably not going to tell you!

Posted by Teresa on August 21, 2009 under Fair Housing Act, Landlord Tips, Tenant Screening & Background Checks |

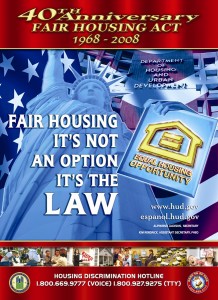

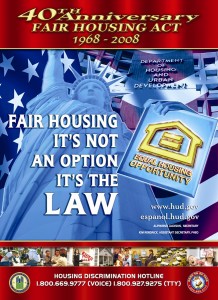

The Fair Housing Act, also known as Title VIII of the Civil Rights Act of 1968, prohibits landlords from discriminating against applicants on the basis of race, color, national origin, religion, sex, family status and disability. Various Executive Orders cover more details, such as requiring federal agencies to promote and further fair housing in the programs and prohibiting discrimination in the sale or leasing of properties owned by the federal government or provided with federal funds.

The Fair Housing Act, also known as Title VIII of the Civil Rights Act of 1968, prohibits landlords from discriminating against applicants on the basis of race, color, national origin, religion, sex, family status and disability. Various Executive Orders cover more details, such as requiring federal agencies to promote and further fair housing in the programs and prohibiting discrimination in the sale or leasing of properties owned by the federal government or provided with federal funds.

The FHA covers most housing in this country, but there are certain exemptions in some circumstances. If you need to know if your circumstances qualify for an exemption, check with your attorney.

Specifically prohibited actions based on the definition of the FHA in leasing situations include:

- Refusing to rent housing

- Making housing unavailable

- Setting different terms, conditions, or privileges for rental of a dwelling

- Providing different housing services or facilities

- Falsely denying that housing is available for inspection or rental

It is also illegal to threaten, coerce, intimidate or interfere with anyone exercising or assisting others to exercise their rights under the FHA, and to advertise or make a statement that indicates any limitation to housing or preferential treatment in offering housing based on race, color, national origin, religion, sex, family status, or disability.

In addition, the Fair Housing Act prohibits landlords from discriminating against tenants with physical and mental disabilities, and requires them to allow reasonable modifications to the dwelling unit to accommodate their disability. This can be done at the tenant’s expense, and, where reasonable, you may require that they return the unit back to its original condition when they move out. For example, allowing a disabled tenant special parking when requested is required.

Landlords are also required to make reasonable accommodations for disabled tenants who require service animals. Even if you have a “no pets” policy, you must allow service animals, which are not considered pets.

However, the FHA does not require that landlords make housing available to persons who are direct threats to the health and safety of others or who use illegal drugs.

Remember, you are within your rights when

screening tenants prior to leasing. For more landlord resources, including forms and information on

tenant screening, turn to

E-Renter.com. You’ll know that you have the best possible tenants when you

prescreen tenants.

Posted by Teresa on August 14, 2009 under Landlord Tips, Tenant Credit Checks, Tenant Screening & Background Checks |

Some people love being landlords. But not everyone does—and not everyone who invests in rental property is cut out for the job. It’s hard work and can be very stressful at times.

Some people love being landlords. But not everyone does—and not everyone who invests in rental property is cut out for the job. It’s hard work and can be very stressful at times.

Whether you’ve been a landlord for ten years or ten months, the time could come when you’re not sure you want to keep going. Here are some ideas for when the role of “landlord” is one you wish you could shed like a winter coat on a hot day!

1. Don’t let your properties own you. Maintaining balance is important. If you’re spending more time on property issues than you want to be, only you can make a change.

2. If you’re spending too much time maintaining your properties and making repairs, hire someone to do it for you. There are probably hundreds of handyman-type services in your area. Ask friends for recommendations and interview several before making your choice. Remember to ask for references and check them!

3. Consider a property management company: Not only will they collect the rent and fill your rental units, property managers also screen tenants and conduct background checks. Plus they handle all the bookkeeping and emergency issues! Sounds like a dream come true—but they do have certain disadvantages: property managers are not free, and unless you own multiple properties, hiring one doesn’t make sense

4. Keep your eyes on the prize: If you’re investing in real estate for the long term, remember that setbacks and headaches you’re dealing with today will be worth it when it’s time to retire, if you’ve managed your cash flow properly. Building a portfolio takes time. Be patient.

5. Find tenants you’ll enjoy dealing with. You can’t control everything about your tenants, but by carefully choosing and always screening tenants, your chances of finding folks you get along with are certainly increased. You must not discriminate against anyone based on Equal Housing laws, but properly worded advertisements and finding tenants through friends and acquaintances are two great ways to start the process.

6. Take the headache out of renting to bad tenants—before they become tenants. Credit checks will ensure you have a tenant who will more likely pay rent on time. Background checks will help you find tenants with good job histories.

Every landlord goes through difficult times. If you’re having one of those, take a deep breath, get some exercise, go on a vacation, or hire someone else to deal with your problems! If you can raise the rents to cover the increased expenses, you may find it well worth it!

Posted by Teresa on August 4, 2009 under Housing Trends, Tenant Credit Checks, Tenant Screening & Background Checks |

As the housing market struggles to recover from its historic downturn, thousands of new condominiums remain unsold across the country. Many cash-strapped developers are turning to leasing unsold units—which can cause problems among residents who purchased theirs.

As the housing market struggles to recover from its historic downturn, thousands of new condominiums remain unsold across the country. Many cash-strapped developers are turning to leasing unsold units—which can cause problems among residents who purchased theirs.

Condos are usually rented by their owners—not by the developers of a project. But when the majority of units have not sold, developers—and their lenders—get more creative. Renting is one way to fill units and improve cash flow. And in this economy, cash is king!

But is renting to unknown tenants okay with the owners in the building? Often, it depends on numbers. A few rented units, while a risk for the developer because they can no longer be sold as “new,” are usually not a problem with the owner-neighbors. But when a majority of units are rentals, it can hurt property values—and discourage potential buyers, too. Renting condo units can become a sure way to prevent selling units—an unending cycle.

However, even if condo owners don’t like buildings inhabited by renters, there is usually little they can do about it. Most developers will reserve the right to lease unsold units in the sales contract—and buyers have already agreed to it.

If you’re a developer with unsold condo inventory on your hands, you might consider renting units to quality, pre screened tenants. You can appease unit owners by assuring them the condos will be rented only to tenants who have passed background checks, including credit checks and criminal history screening. You’ll sleep better, too, when you properly screen tenant applicants!

Besides, condo owners might consider themselves lucky to not own a unit in a certain luxury building in New York City—where the owner is renting unsold units to a homeless shelter. Sometimes you do what you have to do—and at least the homeless are benefiting.

Posted by Teresa on July 31, 2009 under Landlord and Tenant FAQs, Tenant Screening & Background Checks |

Managing rental property is really about managing people—and since there are all kinds of people, you’ll be dealing with all kinds of unusual and interesting requests from tenants. Just when you think you’ve heard them all, a new tenant will ask for a favor, or a prospective tenant discloses something you’ve never dealt with.

Managing rental property is really about managing people—and since there are all kinds of people, you’ll be dealing with all kinds of unusual and interesting requests from tenants. Just when you think you’ve heard them all, a new tenant will ask for a favor, or a prospective tenant discloses something you’ve never dealt with.

Here are a few issues you might not have encountered before:

A prospective tenant intends to run a daycare from your property: You’ll definitely want to run this by your insurance company and possibly even your attorney. In case of injury, any liability could be considered shared between you and the day care provider. You may not reject their application solely for this reason in certain states. Check your local and state laws to protect yourself. If everything checks out and you feel comfortable with the situation, you’ll also want to check your local zoning laws, and require your tenant to hold liability insurance with yourself named as additional insured.

On the flip side: you discover a tenant is running a daycare without your permission: If the tenant did not disclose the business up front, you may have grounds for eviction.

A new tenant wants to prepay a year’s rent: At first glance, this might not seem like a problem. But you should definitely check out the tenant’s income source by running a background screen. If they have legitimate income and otherwise pass the screening, you might want to consider the request. But don’t spend it all at once—six months down the road, they may decide to move!

If you allow pets in your units, should you allow a pit bull? Check with your insurance company. They usually have a list of “vicious” dogs that are not allowed under their coverage. Even if the dog is friendly and well-behaved, if your insurance company says “no,” you should, too.

If you don’t allow pets, what about a seeing eye dog? We’ve covered this topic in this blog before. Service animals are not considered pets, and are not subject to pet restrictions.

If you do allow pets, should you charge a pet deposit for a service animal? While you are certainly allowed to, most landlords do not. Again, since service animals are not considered pets, your normal pet rules do not apply.

Posted by Teresa on July 17, 2009 under Eviction, Landlord Tips, Tenant Screening & Background Checks |

Whether you’re an experienced landlord, or a “newbie,” you probably have your share of missteps made in your rental property business. And while some landlords make the same mistakes over and over again, you don’t have to be that guy or gal.

We’ve rounded up a list of common landlord mistakes so you can avoid them!

1. Not treating it like a business. Because it is! You are in the property rental business to make money, not to house the world at your expense. Establish and follow procedures, open separate bank accounts, keep meticulous records, get professional help when necessary, and project a professional demeanor to your tenants. As one landlord put it, “If you look and sound like you’re not serious, you won’t be taken seriously.”

2. Being too lenient on rent collection. Your tenants signed an agreement to pay you on a certain date. Don’t allow late or partial rent, or they will know you’re not serious about the due date. See mistake #1.

3. Failure to prescreen tenants. Don’t be in a hurry to fill a vacancy, or you could end up with an unreliable tenant—which is a much bigger problem than an empty unit. Have your employment checks, background checks and credit checks in hand before you sign a lease with any tenant.

4. Lack of understanding about operating expenses. There is more to owning rental property than collecting rent and paying the basics: principle, interest, taxes, and insurance. If you don’t have sufficient resources to cover regular expenses (maintenance, advertising, repairs) PLUS accessible funds to cover the occasional (but inevitable) major repairs, you are setting yourself up for failure.

5. Trying to do everything yourself. If you have only one or two properties to manage, you might be able to handle rent collection and upkeep. Still, you might need a handyman for maintenance. But if you have more than three rental properties, consider hiring a property management company for tenant screening and placement, upkeep, rent collection, maintenance, etc. Ask yourself what your time is worth. You may find the expense of a management company is well worth your freedom from stress.

6. Not having an exit strategy. Before you buy an income property, do your homework—including how easy or difficult it will be to sell when you need or want to. You never know when you’ll want out of a rental property, but the likelihood is that you will sell eventually.

7. Not evicting non-paying tenants immediately. Even if you properly screen tenants, anything can happen. If your tenants break the rental agreement by not paying on time, you can—and should—take the proper legal steps for eviction. See mistakes #1 and #2.

8. Being a hands-off landlord. Although you may have a property management company, no one will care about your rental properties like you do. At the very least, inspect your properties on a regular basis and stay in touch with your tenants. You’ll probably prevent a lot of damage and trouble just by following this simple step.

Posted by Teresa on July 14, 2009 under Landlord Tips, Tenant Credit Checks, Tenant Screening & Background Checks |

In a college town, chances are you could fill your rental properties with students if you chose to. What are the advantages and disadvantages of leasing to college students? What should you look out for?

In a college town, chances are you could fill your rental properties with students if you chose to. What are the advantages and disadvantages of leasing to college students? What should you look out for?

Students can be good tenants, or bad tenants—just like the rest of the population. They are also willing to pay top dollar in many cases. If you are clear with college students and let them know your expectations, you can be a successful college student landlord!

Since the new school year is coming up quickly, here are some Dos and Don’ts for considering student tenants:

1. Do make sure you have an iron-clad lease. Have a lease or real estate attorney draw it up for you.

2. Do specify that each individual tenant is responsible for the entire rent. Then, if one moves out, the remaining roommates cannot claim they don’t that person’s share.

3. Do remember that the security deposit won’t cover the potential damage that can be done to your property. Make sure the lease assigns responsibility for damages and losses.

4. Do consider the extra maintenance or repair costs when establishing your rent. Repainting, and replacing carpet and more often, as well as repairing damages, should be considered standard operating procedure.

5. Do specify noise restrictions in the lease. College students like to party, and even small gatherings can become out-of-control in no time at all. Let your prospective student-tenants know that if the police are called to your property due to noise complaints, it is grounds for eviction.

6. Don’t allow “squatters.” If your tenants want to have overnight guests, enforce a 7-day (or however many you deem reasonable) limit.

7. Do specify lease dates: is the lease period for the school year or for a 12-month period? Students might think “one year” means August – May! Be sure the tenant knows the number of months they are responsible for paying rent.

8. Don’t allow anyone who is not on the lease to live in the rental unit. Period. You have no protection against their actions if they have no binding lease agreement with you.

9. Do prescreen all applicants to verify employment history, criminal history, and credit history.

10. Don’t allow the students alone to sign the lease. Require co-signers, such as their parents, and conduct proper credit screening on co-signers, as well—before you offer to lease your property.

11. Don’t hesitate to call the co-signers/parents at the first sign of trouble.

12. Do keep the communication open with your tenants—if they’re late, follow up immediately, from day one, to break bad habits. And, if they’re respectful, clean, and quiet (hey, it could happen!), let them know you appreciate it.

13. Do check your local zoning laws for maximum number of residents allowed in a housing unit—but if you follow suggestion #1, your lawyer will know for sure!

Posted by Teresa on July 10, 2009 under Landlord and Tenant FAQs, Tenant Credit Checks, Tenant Screening & Background Checks |

From time to time, we get a handful of rental property-related questions that concern many landlords—but don’t fall neatly into any category. We hope you find one or two that you’ve been wondering about, too!

From time to time, we get a handful of rental property-related questions that concern many landlords—but don’t fall neatly into any category. We hope you find one or two that you’ve been wondering about, too!

Q: My rental unit has a jetted tub. If it breaks, am I responsible for repairing it—or replacing it with the same type tub?

A: You might want to consider adding a clause in your lease agreement that states the jetted tub is as is; the tub itself will be maintained for bathing purposes; however, if the jets malfunction, they will be repaired at your discretion only.

Q: I live in a city where only the owner of the property can be billed for the water and sewer service. How can I handle this with my tenants? I’m afraid they’ll run up the water bill, since they’re not paying it.

A: Your lease can state that you will pay for a certain amount of the water and sewer, based on average rates in your area. The lease can require the tenant to pay anything above that amount, to be included with the following month’s rent.

Q: Is it necessary to prescreen tenant applicants if they were referred by a good friend of mine?

A: Not only is it necessary, it is the most important thing you can do to protect yourself, your other tenants and the neighborhood residents. You need the peace of mind that a professional credit and background check will bring you. But just as important, if you don’t follow consistent procedures for each applicant, you could be accused of discrimination. Apply the same rules and follow the same procedures on every single tenant applicant—no matter who recommends them!

Q: What’s the absolute most effective way to advertise my for lease property?

A: Landlords we talk to say that good signs in the yard or window, visible from the street, plus an ad with photos on Craigslist.com, are the two best ways to advertise. Do beware of scams on Craigslist—read the warnings posted on the site and don’t allow anyone you have not personally met send you a check to hold a rental—many scammers operate like this.

Q: What should I do to make my rental property appealing to high-quality tenants?

A: Give your rental the best curb appeal possible! Get rid of unsightly trash, hide the trash cans, trim shrubs and low-hanging branches, and plant some new flowers. Repair any broken windows or screens, and paint the trim if it’s needed. A bright color for the front door is a great way to make the property pop!

Q: How do I know when it’s time to hire a property management company?

A: If you no longer enjoy or have the time to spend on property maintenance, dealing with tenant questions and problems, and finding new tenants, you should research property managers. Base your decision on the out-of-pocket expense; if you decide your time and peace of mind is worth more than what you’ll pay the management company, give it a try!

It’s rather difficult to find anyone who has not been affected by the economic troubles of the past year. That includes people who want to be your tenants. What should you look for when running tenant credit checks these days? If everybody’s credit is bad, why bother to do a credit check? Should landlords and property managers lower their standards in light of the rise in rental vacancies? Read on for answers to these questions.

It’s rather difficult to find anyone who has not been affected by the economic troubles of the past year. That includes people who want to be your tenants. What should you look for when running tenant credit checks these days? If everybody’s credit is bad, why bother to do a credit check? Should landlords and property managers lower their standards in light of the rise in rental vacancies? Read on for answers to these questions.

Some people love being landlords. But not everyone does—and not everyone who invests in rental property is cut out for the job. It’s hard work and can be very stressful at times.

Some people love being landlords. But not everyone does—and not everyone who invests in rental property is cut out for the job. It’s hard work and can be very stressful at times.